Everything about Scj Cooper Realtors

Wiki Article

The smart Trick of Scj Cooper Realtors That Nobody is Talking About

Table of ContentsAll About Scj Cooper RealtorsThe Best Strategy To Use For Scj Cooper RealtorsMore About Scj Cooper RealtorsScj Cooper Realtors Things To Know Before You Get ThisThe Basic Principles Of Scj Cooper Realtors The Ultimate Guide To Scj Cooper Realtors

You might also have a hard time to locate sufficient tenants to fill up that workplace building or retail facility you purchased. This is when you acquire a house for a lower price, renovate it promptly and after that sell it for a rapid profit.You're not interested in monthly rental fees when flipping a house. Instead, you require to purchase a home for the least expensive feasible price if you want to make a great earnings when marketing.

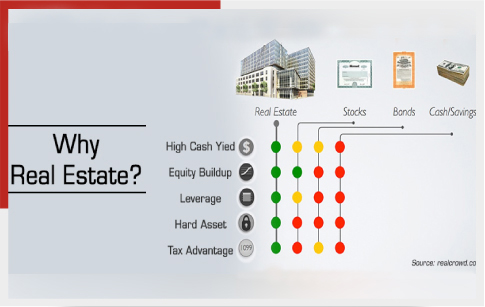

Diversifying your financial investment profile is crucial. If you place all your eggs in one basket, you could suffer a failure in the blink of an eye. When you invest some funds in the stock market, other funds in bonds or ETFs, and some in genuine estate, you boost your opportunities of higher profits as well as less losses.

Scj Cooper Realtors - The Facts

Neither is exact, and also to guarantee you, below are 8 great reasons why property is an excellent investment. The Leading Factors Property Is an Excellent Investment If you're thinking of buying realty, you're about to begin on one of the ideal investment journeys of your life time.There aren't a lot of other investments that enable you to spend in properties worth a lot even more than you need to invest. For example, if you have $10,000 to purchase the stock exchange, you can normally get simply $10,000 worth of stock. The exemption is if you spend for margin (obtain), yet you must be a recognized capitalist with a high net worth to make that take place.

Allow's claim you discovered a residence for $100,000; if you place down $10,000, chances are you could discover a loan to finance the rest as long as you have great debt and stable earnings. Keeping that, it indicates you invest just 10% of the property's value as well as possess it.

Some Known Incorrect Statements About Scj Cooper Realtors

You will not get a dollar-for-dollar return on your investments, yet some renovations can pay you back as long as 80% 90% of the cash invested. The improvements don't need to be significant either. Obviously, including a room or completing the basement will certainly include even more worth than simple cosmetic improvements, yet even minor kitchen and also washroom restorations can considerably impact a residence's well worth.

While it's an investment, when you own a house and also lease it out, you run a company you are the proprietor. As business proprietor, you can often write off the following expenses: The home loan interest paid on the financing Source points paid on the loan Upkeep costs Depreciation (expanded over 27.

Get This Report on Scj Cooper Realtors

When you purchase supplies or bonds, you can only create off any type of capital losses if you offer the property for less than you spent for it. If you buy and hold real estate, you can gain monthly capital leasing it out, and also this increases the benefit from possessing realty considering that you aren't counting only on the appreciation however the month-to-month rental earnings (scj cooper realtors).

Without risk, there can not be an incentive. There's very little to feel safe and secure regarding when you invest in the marketplace. Yet, as 2020 revealed, it can transform in the blink of an eye. One min you have a considerable financial investment, as well as the following, you've lost every little thing. When you purchase genuine estate lasting, you understand you have an appreciating property.

What Does Scj Cooper Realtors Do?

Lots of people buy actual estate to supplement their retired life earnings. scj cooper realtors. Whether you have the property while you're retired, making the monthly rental capital to supplement your earnings, or you sell a home you've had for years once you remain in retirement as well as make a revenue, you'll raise your retirement income.If acquiring realty and also leasing it out is too difficult for you, there are many other methods to invest in realty, consisting of: Buy an undervalued residential property, fix it up as well as turn it (repair and also flip) Be a https://www.scjcooperrealtors.com wholesaler working as the center guy in between motivated sellers and also a network of customers.

Buy a Realty Investment Trust fund If you wish to leave a legacy behind however do not think going money is a good idea, passing property down can be even better. Not only will you provide your beneficiaries an income-producing property, but it's likewise a valuing property. They can either maintain the home as well as let the legacy continue or sell it and also earn revenues.

The smart Trick of Scj Cooper Realtors That Nobody is Discussing

As an example, let's state you have $50,000 equity in a residence. You can refinance the home loan on it, take out the $50,000, and use it as a down repayment on your next residential property. Depending on the worth of your residential or commercial properties, you might also be able to pay cash money for future buildings, boosting your portfolio and also the equity in it also quicker.While there's not a one-size-fits-all answer, there are certain credit to search for when you invest in property, consisting of: Look for an area that's attractive for tenants or with fast valuing homes. Make sure the location has all the services as well as eases most homeowners desire Look at the location's criminal activity rate, college rankings, as well as tax background.

Report this wiki page